Holiday Season Money Tips

This category is all about the holiday season and how to save money, holiday season budgeting tips, holiday season money challenges, holiday season activities save money and more

-

10 Holiday Money Saving Challenges

Holiday Money Saving Challenges are a fantastic way to inject an element of fun and motivation into the often hectic and expensive holiday season.

Holiday Money Saving Challenges are a fantastic way to inject an element of fun and motivation into the often hectic and expensive holiday season. These challenges are designed to encourage individuals and families to save money in creative and engaging ways. Whether it’s the classic “365-Day Money Challenge,” where you incrementally save a specific amount each day, or a themed challenge that involves reducing unnecessary expenses, these challenges promote financial discipline and goal-setting during a time when spending can easily spiral out of control.

They provide a structured framework for saving, helping participants set realistic targets and watch their savings grow over the weeks or months leading up to the holidays.

Additionally, holiday money-saving challenges foster a sense of accomplishment and pride as participants see their efforts translate into extra funds for holiday shopping, travel, or simply building a more secure financial future. These challenges also encourage people to think outside the box, discover clever ways to cut costs, and foster a spirit of financial responsibility while still embracing the festive atmosphere of the holiday season. Ultimately, holiday money-saving challenges transform saving money from a chore into an exciting journey, and they demonstrate that with a bit of determination and creativity, you can celebrate the holidays without breaking the bank.

.

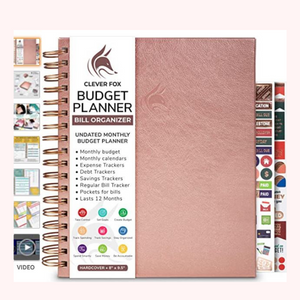

Budget Planner

Budget PlannerThis is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar that tracks spending & savings

- 4 pages for debt tracking, 2 pages for Holiday budgeting,

- 2 pages for regular bill tracking, and 2 pages for annual

.

Cash Method Binder

Cash Method Binder This cash binder is great for cash budgeting method

- Can easily use the cash method

- Can easily organize track your cash

- Comes with 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

.

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

.

.

1. The 25-Day Advent Challenge

- This classic challenge involves saving a specific amount each day for 25 days leading up to Christmas. Start with $1 on Day 1, $2 on Day 2, and so on, until you reach $25 on Day 25. By the end of the challenge, you’ll have $325 saved for holiday expenses

Participants eagerly open a daily ‘savings door,’ revealing a new and engaging way to save money. These challenges can vary from simple actions like packing lunch instead of eating out to more substantial steps like setting aside a specific amount each day. By the time Christmas arrives, participants not only have a significant amount of money saved but also a sense of accomplishment and the satisfaction of having celebrated the holidays in a financially savvy way. The 25-Day Advent Challenge is a heartwarming and exciting approach to embracing the holiday spirit while nurturing responsible financial habits.

.

2. The Reverse Savings Challenge

- Flip the savings challenge around by starting with a larger amount and decreasing it each day. Begin with $25 on Day 1 and subtract $1 each day until you reach $1 on Day 25. You’ll still have $325 by Christmas.

Instead of starting with small amounts and gradually increasing them, as seen in traditional savings challenges, the Reverse Savings Challenge begins with a significant amount and reduces the savings goal as time progresses. Participants commit to saving a substantial sum at the beginning, often aligning with their specific financial goals, such as a holiday shopping budget, a vacation fund, or an emergency fund.

As time passes, the amount to be saved decreases, allowing participants to ease into their savings routine without the pressure of increasing contributions. This approach recognizes that it can be challenging to consistently save larger sums, especially during the holiday season, and thus encourages people to prioritize their financial goals early on. The Reverse Savings Challenge offers a realistic and effective strategy for building financial resilience and achieving specific savings objectives, making it a practical and strategic approach to holiday money saving.

.

3. The Weekly Savings Challenge

- Save a set amount each week, such as $10 in Week 1, $20 in Week 2, and so on, until you save $50 in Week 5. Over five weeks, you’ll accumulate $150 for the holidays.

The Weekly Savings Challenge is a fantastic and versatile approach to saving money that suits a variety of financial goals and lifestyles. In this challenge, participants commit to saving a specific amount of money each week throughout the year, which can be adjusted to align with their unique financial situation and objectives. It’s an ideal method for cultivating a consistent savings habit, as it’s not overly burdensome and can be customized to suit individual budgets.

It serves as an excellent financial discipline tool, encouraging people to prioritize savings in their budget and create a sense of financial security. The challenge promotes the gradual growth of savings over the course of a year, cultivates a habit of consistent saving that extends well beyond the festivities, making it a highly effective and adaptable approach to holiday money-saving

.

4. The Spare Change Challenge

- Collect your spare change throughout the holiday season and deposit it into a designated savings jar. Those coins can quickly add up to a substantial amount by the end of the season.

The Spare Change Challenge is a clever and painless way to save money that leverages the loose coins and small bills that often accumulate in our daily lives. It encourages participants to collect and set aside their spare change, putting it to work for their financial goals. The simplicity of this challenge is its key strength; it requires no complex calculations or large contributions.

Over time, this seemingly insignificant change can amass into a significant sum, making it an ideal method for funding holiday expenses or any other financial goal.

.

5. The DIY Gift Challenge

- Challenge yourself to create homemade gifts for your loved ones. This not only saves money but also adds a personal touch to your holiday presents.

The DIY Gift Challenge is a heartwarming and budget-friendly approach to the holiday season that emphasizes creativity, personalization, and thoughtfulness in gift-giving. In this challenge, participants commit to creating their own gifts instead of purchasing store-bought items. Whether it’s handcrafted ornaments, homemade baked goods, or personalized photo albums, the DIY Gift Challenge encourages individuals to invest their time, skills, and love into crafting unique presents for their loved ones. This approach not only saves money but also offers the opportunity to express genuine care and consideration for the recipients.

It’s an embodiment of the true spirit of gift-giving, where the thought and effort behind the present often mean more than its price tag.

.

6. The No-Spend Weekend Challenge

- Designate certain weekends as “no-spend” weekends, during which you avoid making any unnecessary purchases. The money saved can be set aside for holiday spending.

The No-Spend Weekend Challenge is a practical and eye-opening approach to saving money that encourages participants to temporarily cut back on their discretionary spending during weekends. In this challenge, individuals commit to refraining from making any non-essential purchases over the course of a weekend. This can include dining out, shopping for non-essential items, or indulging in entertainment that comes with a price tag.

It helps participants distinguish between needs and wants, fostering a more conscientious approach to their finances. Moreover, it offers the opportunity to explore alternative, cost-effective activities, such as picnics, hiking, or at-home movie nights, which can be equally enjoyable without the expense. By consistently implementing this challenge, participants can build up significant savings that can be directed toward holiday expenses or other financial goals. It is a powerful and pragmatic approach to curbing unnecessary spending, leading to a more financially secure and mindful approach to budgeting.

.

7. The Second-Hand Shopping Challenge

- Commit to buying holiday decorations, gifts, or clothing from thrift stores or online marketplaces like eBay or Facebook Marketplace. You’ll find unique and affordable items.

The Second-Hand Shopping Challenge is a sustainable and budget-friendly approach to holiday shopping that involves seeking out pre-owned or thrifted items instead of purchasing new ones. In this challenge, participants commit to exploring second-hand stores, garage sales, online marketplaces, and other sources for gently used items that can serve as gifts or holiday decorations.

It also emphasizes the value of thoughtful and sustainable gift-giving, as second-hand items often come with interesting histories or stories. Additionally, this challenge provides an opportunity to support local thrift stores and contribute to a circular economy.

.

8. The Energy-Saving Challenge

- Cut down on energy consumption by using LED lights, lowering your thermostat, and unplugging devices when not in use. The money saved on utility bills can fund your holiday expenses.

The Energy-Saving Challenge is an eco-conscious and financially savvy approach to the holiday season that focuses on reducing energy consumption in and around the home. During the holidays, many of us indulge in festive lighting and decorations, which can significantly contribute to higher energy bills.

In this challenge, participants commit to making small yet impactful changes to their energy habits, such as using LED lights for decorations, setting thermostats at energy-efficient temperatures, or unplugging devices not in use. The goal is to enjoy the holiday season while being mindful of energy usage, which not only benefits the environment but also leads to lower energy bills.

.

9. The Potluck Challenge

- Host potluck dinners or gatherings with friends and family, where everyone contributes a dish. This reduces the cost of entertaining while enjoying a variety of foods. In this inflation – this seems like a great idea and not burden one wallet.

The hosting party invites their guests to contribute dishes or food items, turning the gathering into a potluck-style feast. This approach not only reduces the financial burden on the host but also encourages a sense of togetherness and shared celebration. It allows everyone to showcase their culinary talents and cultural traditions, resulting in a rich and diverse spread of dishes and embodies the true spirit of holiday celebrations, emphasizing the joy of sharing and community.

.

10. The Give-Back Challenge

- Instead of spending on traditional gifts, donate to a charity or cause that resonates with you. You can choose to make a one-time donation or set up a recurring contribution throughout the season.

The Give-Back Challenge is a heartwarming and impactful approach to the holiday season that centers around acts of kindness, generosity, and community involvement. In this challenge, participants commit to dedicating a portion of their time and resources to giving back to their community or supporting charitable causes.

This can include volunteering at local organizations, donating to food drives, sponsoring families in need, or simply spreading kindness in their daily interactions. It encourages individuals to reflect on the true meaning of the holidays, which is not solely about material gifts but also about love, compassion, and helping those in need. This challenge fosters a sense of empathy, unity, and social responsibility, as participants come together to make a difference in the lives of those less fortunate.

.

Conclusion

With these 10 Holiday Money Saving Challenges, you can enjoy the festive season without financial stress. Whether you opt for the Advent Challenge, the DIY Gift Challenge, or the Give-Back Challenge, there are plenty of creative ways to save money while creating joyful holiday memories. Explore the provided examples and links to help you plan an affordable and successful holiday season, filled with financial prudence and seasonal delight. Happy Holidays and the true meaning is being around the ones you love and spreading love.

.

-

10 Thoughtful Holiday Money Gift Ideas

Holiday money gift ideas can be both practical and heartfelt, making them a thoughtful choice for family and friends.

Holiday money gift ideas can be both practical and heartfelt, making them a thoughtful choice for family and friends.Rather than a traditional gift, consider giving the gift of financial empowerment. For a college student, you might contribute to their textbook fund, helping them with their education expenses.

For a young couple, a contribution towards their first mortgage payment or a fund for a future family vacation can be a game-changer. You could also introduce the idea of investing by gifting stocks or bonds, promoting financial literacy alongside the holiday spirit.

Alternatively, offer a gift card for a financial planning session, helping someone start the new year with a solid financial strategy. These money-related gifts not only demonstrate your care but also set your loved ones on a path toward financial security and success.

The holiday season is a time for giving, and sometimes the most appreciated gifts are those that offer financial flexibility or help someone achieve their financial goals. Whether you’re shopping for a friend, family member, or even looking for ways to treat yourself, consider these 10 thoughtful holiday money gift ideas that go beyond traditional presents and can make a lasting impact. This can truly be a better option when it comes to gifting to someone. It is never to late to start the financial journey and this method has become one of our favorite ways to spent the holiday season.

.

1. High-Yield Savings Account

A high-yield savings account is an excellent and thoughtful holiday money gift idea that can provide long-lasting financial benefits. It offers a secure and rewarding way to save and grow money over time.

Consider opening or contributing to a high-yield savings account for a loved one, such as a child, a grandchild, or a friend, and provide them with a head start on their financial journey. High-yield savings accounts typically offer higher interest rates than traditional savings accounts, which means that the recipient’s money will grow at a faster pace.

This gift not only teaches the importance of saving but also instills the concept of earning money through interest. It can serve as a financial safety net, an emergency fund, or a future investment for the person you care about.

.

2. Investment Portfolio Starter Kit

An investment portfolio starter kit is a thoughtful and empowering holiday money gift idea, especially for someone who wants to begin their journey into the world of investing. This retirement planning guidebook, helps to lay the foundation of how to properly setup your retirement plan

Retirement Planning Guidebook

Retirement Planning GuidebookThis guidebook certainly helps in laying a strong foundation.

- Assess where you wish to live in retirement

- Manage your long-term care risk between self-funding

- Investment and insurance tools that fit your personal style

- Make smart decisions for when to start Social Security benefits

- Determine if you are financially prepared for retirement by quantifying your financial goals

An investment portfolio starter kit is a thoughtful and empowering holiday money gift idea, especially for someone who wants to begin their journey into the world of investing. This kit can include educational resources, such as books, online courses, or subscriptions to financial magazines, to help the recipient understand the basics of investing.

It can also include a gift card to an investment platform or brokerage account to kickstart their investment journey. Additionally, consider including a diversified exchange-traded fund (ETF) or a selection of individual stocks to give them a tangible start to their investment portfolio. It’s a gesture that promotes financial literacy and sets them on a path towards building wealth and securing their financial well-being. In a world where financial knowledge is a precious gift, the investment portfolio starter kit is a valuable and thoughtful present for the holiday season.

.

3. Personal Finance Book

Whether it’s a guide to budgeting, investing, retirement planning, or managing debt, a well-chosen personal finance book can serve as a valuable resource to help them make informed financial decisions. This book is helps people understand the dangers of 8 to rat race and the advantages of creating your own financial opportunity.

Cashflow Quadrant Guide

Cashflow Quadrant GuideThe first book was Rich Dad Poor Dad. This is the

second book which reveals how the 1 percent manage, grow, protect their assets such as:- How to work less, earn more, pay less in taxes

- Book is written for those needed to secure financial freedom

- Showcases the different methods how to achieve financial freedom

- Highlights how to strategically move beyond job security and acquire financial literacy

A personal finance book is a wonderful and thoughtful holiday money gift idea that can have a lasting impact on the recipient’s financial well-being. Consider selecting a well-reviewed and highly recommended book on personal finance or investing to empower your loved ones with valuable knowledge and insights.

The gift of a personal finance book not only demonstrates your care for their financial future but also provides them with a tool for self-improvement and financial literacy. It encourages them to take charge of their financial well-being, set and achieve financial goals, and build a more secure and prosperous future.

.

4. Online Course or Workshop

An online course or workshop on personal finance, investing, or a related financial topic is a thoughtful and enriching holiday money gift idea that can have a lasting impact on the recipient’s financial knowledge and well-being. This personal finance book is also a great start

Personal Finance Book

Personal Finance BookThis book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

- Easy Strategies to implement and track your progress

In today’s digital age, there are numerous high-quality online courses and workshops available that cover a wide range of financial subjects. Consider gifting someone you care about access to one of these courses, whether it’s about budgeting, investing, financial planning, or even entrepreneurship.

It’s a present that keeps on giving, as the knowledge acquired through the course can be applied throughout their lifetime, ultimately leading to better financial decision-making and security. By offering the gift of an online course or workshop, you’re giving the gift of financial empowerment and education, making it a considerate and impactful choice for the holiday season.

.

5. Debt Payoff Contribution

Help someone pay off their debt by making a contribution to their student loans, credit card debt, or mortgage. A debt payoff contribution is a thoughtful and caring way to offer support during the holiday season and beyond. This book helps on to to track and stay out of debt.

Payoff Debt Fast

Payoff Debt Fast This book showcases the best way to quickly erase different types of debts.

- How to correctly payoff debt and correctly borrow money

- Includes how to manage different types of interest rates

- Interest Rates, Credit Scores, Student Loans, Debt Payoff Strategies

- Cheaply manage debt, Essential Primer on Managing Debt

- Use credit wisely with this easy-to-understand, comprehensive guide

By contributing to the repayment of their debt, you not only provide immediate financial relief but also offer emotional support and encouragement.

Whether you’re helping a family member, a close friend, or a loved one, your contribution towards their debt can have a profound impact on their financial well-being and peace of mind. It demonstrates your understanding of their financial struggles and your commitment to their financial success. Your gift can expedite their journey towards debt freedom and help them regain control of their finances. It’s a gesture of generosity and empathy that can significantly reduce their financial stress, allowing them to start the new year with a brighter financial outlook.

.

6. Business Seed Money

There are many ways to achieve financial freedom, but most people have achieved this stage through operating a business. In this day and age, starting a business has become much simpler, it all about having a winning strategy. This book is a great start to put your ideas on paper.

Business Workbook Planner

Business Workbook PlannerThis workbook is great for side hustles or entrepreneurs starting their journey, as it shows step by step process of creating a business.

- Insider tips from successful entrepreneurs

- Legal guidelines to protect your assets

- Budget and forecast tools

- How to avoid the pitfalls that doom most startups

- Guidance on how to scale and grow

- Suggestions on how to dominate online platforms

- Tips to beat your competitors with SEO and social media

Most people start a side hustle, and then grow it into a full time business. There are many advantages to do, but the most imperative strategy is to be focused and put in work. Planning is a crucial step to this process. Whether its a side hustle, or full time business setting the business correctly is a must and this workbook is clearly a needed requirement.

.

7. Financial Planning Session

A financial planning session is a thoughtful and empowering holiday money gift idea that offers the recipient valuable insight and guidance on managing their finances.

Financial Budget Planner

Financial Budget Planner It has many financial tips, trackers and and strategies to implement along the way.

- Budgeting Book with Income and Expense Tracker

- Comes with daily, weekly, monthly and yearly budgets

- Has spacious pocket for all your bills, set annual financial goals, build a viable strategy,

Many people may struggle with budgeting, saving, investing, or planning for their financial future, and a financial planning session can provide them with the knowledge and tools to make informed decisions. By gifting a financial planning session, you are offering the gift of financial literacy and control. This session can cover a wide range of topics, from budgeting and debt management to retirement planning and investment strategies. It’s an opportunity for the recipient to receive personalized advice and create a roadmap for their financial success. This financial planner is a great start, to organize, manage finances and create a financial roadmap.

.

8. Emergency Fund Seed Money

An emergency fund is a financial safety net that can help cover unexpected expenses, such as medical bills, car repairs, or job loss, without resorting to high-interest loans or credit card debt. This budget planner certainly helps you in managing your money.

These free printables will help you in organizing your finances, from daily expenses, debt tracker, saving tracker, investment goal tracking and more. Once you organize your daily finances, you tend to be more involved in your long term financial goals. By gifting emergency fund seed money, you are offering the recipient peace of mind and the ability to handle unexpected financial challenges. Budgeting can certainly help in managing all aspects of your finances, from emergency funds, debt payoff, investment contributions to health care needs. This budget planner can certainly be a great starting point.

9. Prepaid Debit Card

A prepaid debit card is a thoughtful and versatile holiday money gift idea that allows the recipient the freedom to use the funds as they see fit. This type of gift card works similarly to a regular debit card, but it’s preloaded with a specific amount of money, which can be spent at various retailers, both online and in physical stores.

Cash Method Binder

Cash Method Binder This cash binder is great for cash budgeting method

- Can easily use the cash method

- Can easily organize track your cash

- Comes with 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

We also love this cash cash envelope system. Some prefer of having physical cash instead of a debt card. Envelope cash system has great benefits and many people have managed to reach their financial goals with this system. This can be a great gift for teaching kids about financial literacy.

Whether it’s for covering daily expenses, indulging in a special treat, or boosting their savings, a prepaid debit card or the cash envelope system is a versatile and thoughtful gift that adds a touch of financial flexibility to the holiday season.

.

10. Charitable Donation in Their Name

Making a charitable donation in someone’s name is a meaningful and heartwarming holiday money gift idea that combines the spirit of giving with a noble cause. By choosing a charity or cause that holds significance to the recipient, you are not only spreading joy during the holiday season but also making a positive impact on the world.

This gift goes beyond the material and focuses on making a difference in the lives of those in need. Whether it’s supporting a local charity, a global humanitarian organization, or a cause dear to the recipient’s heart, a charitable donation demonstrates your thoughtfulness and generosity. It also encourages a sense of social responsibility and philanthropy, which are values that can resonate with the recipient and inspire them to give back.

A charitable donation in someone’s name not only provides assistance to those less fortunate but also conveys your respect for the recipient’s values and passions. It’s a thoughtful holiday present that reflects the true spirit of the season—generosity, compassion, and the joy of making a positive impact on the world.

.

Conclusion

This holiday season, consider stepping away from traditional gifts and opt for something that can truly make a difference in someone’s financial life. From high-yield savings accounts to investment starter kits and personal finance books, these thoughtful money gift ideas show your care and consideration for your loved ones’ financial well-being. By giving a gift that contributes to their financial stability and growth, you’re not only spreading holiday cheer but also helping them pave the way for a more secure and prosperous future.

.

-

15 How to Manage Holiday Travel Expenses

How to Manage Holiday Travel Expenses without breaking the bank all starts with careful planning and applying different strategies that will help you save money.

How to Manage Holiday Travel Expenses without breaking the bank all starts with careful planning and applying different strategies that will help you save money.The holiday season, with its warm gatherings, twinkling lights, and joyful celebrations, is a time we all eagerly anticipate.

It’s a season for creating precious memories and strengthening bonds with loved ones, often necessitating travel to be near those we care about.

Yet, holiday travel expenses can sometimes seem like an obstacle to our festive plans, threatening to break the bank. The good news is that with some thoughtful planning, clever strategies, and a dash of financial wisdom, you can embark on your holiday journeys without the burden of exorbitant costs.

In this guide, we will explore the art of managing holiday travel expenses effectively, ensuring that you can cherish the magic of the season without feeling the strain on your finances. From early planning and budgeting to savvy booking techniques and practical money-saving tips, we’ll take you on a journey to make your holiday travel not only unforgettable but also budget-friendly. So, let’s unwrap the secrets of travel finance and make your holiday trips the stuff of dreams without the nightmare of financial stress.

Budget Planner

Budget PlannerThis is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Comes with a financial calendar that tracks money pages for tracking savings,

- 4 pages for debt tracking, 2 pages for Holiday budgeting,

- 2 pages for regular bill tracking, and 2 pages for annual

.

Cash Method Binder

Cash Method Binder This cash binder is great for cash budgeting method

- Can easily use the cash method

- Can easily organize track your cash

- Comes with 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

.

1. Plan Ahead

One of the most powerful tools in your arsenal for managing holiday travel expenses is the gift of time. As the saying goes, “The early bird catches the worm,” and the same applies to holiday travel. By planning your trips well in advance, you not only secure the best deals on flights and accommodations but also gain the ability to make thoughtful, cost-effective choices. Begin your journey by researching your destination, setting specific travel dates, and booking your flights and accommodations as early as possible. Take advantage of early-bird discounts and promotions, which can save you a significant amount of money. Planning ahead not only relieves the pressure of last-minute expenses but also allows you to allocate your budget more efficiently, ensuring that you can fully enjoy your holiday travels without financial worries.

.

2. Set a Budget

Before embarking on your holiday travel adventure, it’s essential to establish a clear and realistic budget. Knowing how much you’re willing and able to spend ensures that you stay financially responsible throughout your journey. Start by outlining the major cost categories, such as transportation, accommodation, food, and entertainment, and assign a specific budget to each. By having a predefined spending limit, you can make informed choices and prioritize your expenses. Keep in mind that your budget isn’t just about setting restrictions; it’s a tool for financial empowerment. With a well-defined budget, you’ll be in control of your spending, making it easier to balance the enjoyment of your holiday travels with fiscal prudence.

.

3. Use Fare Comparison Websites

When it comes to booking flights and accommodations for your holiday travels, the power of information is your best friend. Fare comparison websites and travel apps are invaluable resources that can help you find the best deals and save significant money. Websites like Skyscanner Kayak Google Flights allow you to search and compare prices across various airlines, travel agencies, and hotel booking platforms. These tools provide a comprehensive overview of available options, enabling you to select the most cost-effective ones. Additionally, fare comparison websites often feature price tracking and alert functions, ensuring you’re notified when prices drop, providing an excellent opportunity to snag the best deals.

.

4. Travel During Off-Peak Times

One savvy approach to keep your holiday travel expenses in check is to consider traveling during off-peak times. Most travelers aim for specific dates during the holiday season, resulting in higher demand and, subsequently, increased prices for flights and accommodations. By opting for less popular travel dates, you can secure more budget-friendly options. Be flexible with your travel schedule, and avoid the busiest days if possible. Whether it’s choosing weekdays over weekends or flying on non-holiday dates, this strategy can lead to considerable savings. You not only benefit from lower costs, but you also get to enjoy less crowded airports, attractions, and accommodations, enhancing the overall quality of your travel experience.

- Traveling during non-peak times can save you money on flights and accommodations. Consider avoiding the most popular travel dates.

.

5. Leverage Rewards and Loyalty Programs

If you’re a member of any travel rewards programs or loyalty schemes, the holiday season is the perfect time to reap the benefits. Airlines, hotels, and credit card companies offer a multitude of opportunities to earn and redeem points or miles, helping you cut down on your travel expenses. Consider using accumulated rewards for flight upgrades, free nights at hotels, or even to cover a significant portion of your trip’s cost. Many loyalty programs also offer special holiday promotions and exclusive deals, so stay vigilant for opportunities to maximize your savings. Whether it’s frequent flyer miles, hotel loyalty points, or credit card rewards, leveraging these programs can make your holiday travel not only more cost-effective but also more luxurious.

- If you have travel rewards credit cards or are part of loyalty programs, this is the time to cash in on points or miles to reduce your expenses.

.

6. Pack Light

An often overlooked but financially savvy aspect of managing holiday travel expenses is to pack light. Many airlines charge extra fees for checked bags, and these costs can quickly add up for a family. By packing efficiently and opting for carry-on luggage, you not only save on baggage fees but also expedite the check-in and security processes, which can be especially beneficial during the hectic holiday season. Traveling with less luggage can also reduce the risk of losing items or incurring additional fees due to overweight bags. Plus, it leaves more room for any holiday souvenirs you may wish to bring back without exceeding your baggage allowance. Packing light allows you to maintain a more streamlined and budget-conscious approach to your holiday travel, making it easier to manage your expenses without compromising on the quality of your journey.

.

7. Opt for Alternative Accommodations

Choosing alternative accommodations can be a smart strategy to keep holiday travel expenses in check. While traditional hotels offer comfort and amenities, they often come with a premium price tag during the holiday season. Instead, consider options like hostels, vacation rentals, or platforms like Airbnb. These alternatives can provide not only budget-friendly options but also unique and memorable experiences. Vacation rentals, for instance, allow you to enjoy the comfort of a home away from home, and you can often find properties that accommodate groups or families, making it cost-effective when shared among several travelers. By opting for alternative accommodations, you can enjoy a cozy and personalized experience without the hefty price associated with traditional hotels, ensuring a more wallet-friendly holiday adventure.

.

8. Cook and Dine Smart

One of the joys of traveling is savoring new cuisines, but dining out for every meal can strain your budget. To manage holiday travel expenses effectively, consider a balance between eating out and cooking budget friendly meals. If your accommodation includes a kitchen or kitchenette, take advantage of it by preparing some of your meals. This not only saves money but also offers a chance to explore local markets and try your hand at preparing traditional dishes. When dining out, opt for local eateries or food stalls that offer authentic and budget-friendly options. By combining dining out with cooking in, you can savor the local flavors while keeping your holiday expenses in check, ensuring that your culinary adventures remain enjoyable and affordable.

.

9. Use Public Transportation

When exploring your holiday destination, making use of public transportation is a cost-effective and environmentally friendly choice. Many cities offer efficient and well-connected public transit systems that not only save you money but also give you the opportunity to experience the local culture and daily life. Avoid expensive taxi rides or the cost of renting a car and opt for buses, trams, subways, or commuter trains. Most cities offer visitor passes or discounted fares for tourists, making it even more affordable. Public transportation not only reduces travel expenses but also minimizes the stress of navigating unfamiliar roads and finding parking, allowing you to enjoy your holiday travels with ease and financial prudence.

.

10. Look for Free and Low-Cost Activities

When it comes to enjoying your holiday travels without straining your budget, seeking out free and low-cost activities is a winning strategy. Most destinations offer an array of attractions and experiences that don’t require a hefty entrance fee. Explore local parks, hiking trails, museums with free admission days, or public art installations. Attend community events, street fairs, and cultural festivals, which often provide enriching experiences at little to no cost. Enjoying a picnic, going for a leisurely stroll, or partaking in people-watching can also be delightful ways to soak in the local culture without spending much. By incorporating these budget-friendly activities into your holiday itinerary, you can make the most of your travels without compromising your financial stability.

.

11. Monitor Your Expenses

A vital aspect of successfully managing holiday travel expenses is keeping a close eye on your spending. It’s easy to get carried away in the excitement of a new destination, but tracking your expenses helps you stay on budget. Use mobile apps or financial tools like Mint You Need A Budget (YNAB) to monitor your spending in real-time. Set specific daily or weekly spending limits, and make adjustments as needed to ensure you don’t exceed your budget. Being aware of your expenditures helps you make informed choices and adapt to unforeseen expenses, all while ensuring that you stay within your financial comfort zone. By maintaining financial discipline and staying vigilant, you can enjoy your holiday travels with peace of mind, knowing that you won’t return home to a financial hangover.

.

12. Travel Insurance

While it’s an additional expense, investing in travel insurance can be a smart financial move during the holiday season. Travel insurance provides you with peace of mind by offering protection against unexpected events such as trip cancellations, delays, or medical emergencies. It might seem like an extra cost, but it can save you a substantial amount of money in the long run. Imagine the relief of having your expenses covered if your trip gets canceled due to unforeseen circumstances or if you require medical treatment abroad. By securing travel insurance, you’re safeguarding your finances and ensuring that you won’t have to bear the full financial burden of unexpected situations, allowing you to enjoy your holiday travels with greater confidence.

.

13. Stay Flexible

Flexibility can be your best friend when it comes to managing holiday travel expenses. Being open to last-minute deals or schedule adjustments can often lead to cost-saving opportunities. Airlines and accommodations may offer discounted rates for travel on less popular days or times. Last-minute deals can also provide significant savings, especially if you have the flexibility to adjust your plans accordingly. Staying open to changes in your itinerary can not only reduce expenses but also add an element of spontaneity and adventure to your holiday travels. By remaining adaptable, you can seize unexpected opportunities to make your journey more affordable while still savoring the magic of the holiday season.

.

14. Minimize Souvenir Expenses

While souvenirs are a delightful way to remember your holiday travels, they can add up quickly and strain your budget. To keep expenses in check, be selective with your souvenir purchases. Choose items that are not only meaningful but also budget-friendly. Consider buying local, handcrafted goods from markets or artisans, as they often offer unique and reasonably priced options. Avoid purchasing souvenirs from tourist-heavy areas, where prices tend to be inflated. Instead, explore local shops and markets, where you can haggle for better deals. Another way to cut costs is by focusing on collecting experiences and memories rather than physical mementos. Enjoy local cuisine, cultural activities, and the company of locals, which often provide a more authentic and budget-conscious way to treasure your holiday adventures.

.

15. Enjoy Free Holiday Activities

The holiday season is filled with an array of free and festive activities that can enrich your travel experience without costing a dime. Many destinations host holiday-themed events like parades, tree lighting ceremonies, and light displays that are open to the public. Explore local traditions and cultural celebrations that often welcome visitors with open arms. Public spaces, parks, and gardens are great places to stroll, relax, and enjoy the holiday ambiance without any expense. Additionally, free walking tours, art exhibitions, or even attending religious services in historic places can offer meaningful and budget-friendly experiences. Embracing these cost-free activities not only keeps your travel expenses in check but also provides a wonderful opportunity to immerse yourself in the holiday spirit and the local culture.

.

Conclusion

Traveling during the holiday season doesn’t have to break the bank. With thoughtful planning, smart budgeting, and the right strategies, you can create lasting memories without the burden of excessive expenses. From setting a budget to utilizing fare comparison websites and seeking out free activities, these tips will help you make the most of your holiday travels while keeping your finances in check. So, pack your bags, embrace the spirit of the season, and embark on an affordable and memorable holiday journey.

.