Debt Payoff

ERASE DEBT FAST. Our best articles on how to quickly get out of debt, debt free living, pay off debt in collections, debt payoff methods and more

-

10 Holiday Season Credit Cards Rewards

Holiday Season Credit Cards can become a valuable ally during this season.

Holiday Season Credit Cards can become a valuable ally during this season.Holiday credit card rewards offer an array of benefits that can help you save money, earn cashback, or even treat yourself to a well-deserved vacation.

From special promotions and limited-time offers to generous rewards for specific categories like shopping and dining, credit cards can enhance your holiday experience.

Setting new financial goals is a central element of your year-end financial review, as it provides you with a roadmap for your financial future. Reflect on your current financial situation, accomplishments, and any challenges you’ve faced throughout the year.

Based on these insights, identify areas in which you’d like to make improvements or where you see opportunities for growth. Your financial goals may vary, from saving for a specific purchase or vacation to increasing your retirement contributions, reducing debt, or expanding your investment portfolio. Setting well-defined and achievable financial goals not only motivates you but also helps you maintain financial discipline. As the new year approaches, consider your short-term and long-term objectives, create an action plan to achieve them, and set benchmarks to measure your progress along the way. By establishing new financial goals in your year-end review, you’re empowering yourself to make purposeful financial decisions and work toward the future you envision.

.

Financial Budget Planner

Financial Budget Planner It has many financial tips, trackers and and strategies to implement along the way.

- Home Finance and Bill Payment Organizer

- Budgeting Book with Income and Expense Tracker

- Comes with daily, weekly, monthly and yearly budgets

- Has spacious pocket for all your bills, set annual financial goals, build a viable strategy,

.

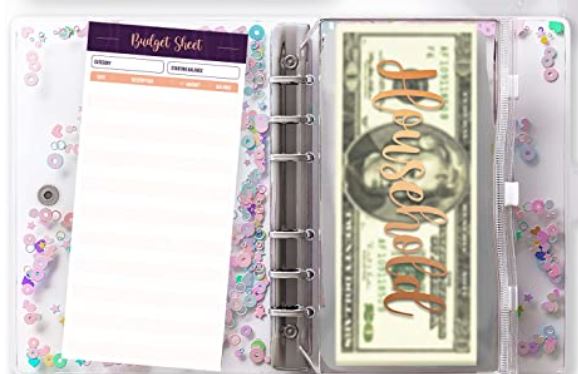

Cash Method Binder

Cash Method Binder This cash binder is great for cash budgeting method

- Can easily use the cash method

- Can easily organize track your cash

- Comes with 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

.

.

1. Choose the Right Rewards Credit Card

Choosing the right rewards credit card is a strategic decision that can significantly impact your financial well-being. Different credit cards offer various types of rewards, and your choice should align with your spending habits and financial goals. Some cards cater to specific interests, such as dining, entertainment, or groceries, providing extra rewards in those categories. Make sure to compare annual fees, interest rates, and additional benefits like insurance coverage or purchase protection. The right rewards credit card can help you maximize your everyday spending, accumulate valuable rewards, and potentially save money or enjoy unique perks based on your preferences and financial needs.

- For example, if you frequently travel, a travel rewards credit card may be your best choice. These cards often offer airline miles, hotel points, and other travel-related perks. On the other hand, if you prefer cash back, a cash rewards credit card is a great option, allowing you to earn a percentage of your purchases back as cash

.

2. Take Advantage of Sign-Up Bonuses

Taking advantage of sign-up bonuses is a smart financial move that can yield immediate benefits. Many credit cards, particularly rewards cards, offer sign-up bonuses to attract new customers. These bonuses typically come in the form of extra rewards points, cashback, or even statement credits, and they can provide a substantial boost to your finances. To make the most of sign-up bonuses, consider the following: Research cards that offer sign-up bonuses that align with your spending habits and financial goals

- For instance, if you love to travel, a card offering a generous bonus of airline miles or hotel points can be highly valuable. Keep an eye on the minimum spending requirement to unlock the bonus, and make sure it’s an amount you can comfortably achieve within the specified timeframe. While the temptation to open multiple credit cards for their bonuses can be alluring, be mindful of the impact on your credit score and your ability to manage multiple accounts responsibly. When used wisely, sign-up bonuses can enhance your financial situation by providing you with extra rewards or funds, whether for a specific purchase, travel, or simply to improve your overall financial well-being.

.

3. Strategically Combine Multiple Cards

Strategically combining multiple credit cards can be a smart financial move, provided it’s done thoughtfully and responsibly. The goal is to maximize the benefits and rewards you receive from each card, catering to different aspects of your spending. For example, you can have one card that specializes in travel rewards, another for cashback on everyday purchases, and a third for dining and entertainment rewards. This approach allows you to tailor your card selection to your spending habits, ensuring you get the most value out of each transaction.

- However, managing multiple cards can be more complex, as you’ll need to keep track of various due dates, credit limits, and rewards programs. It’s crucial to stay organized and disciplined, making payments on time, and avoiding overspending. When done right, strategically combining multiple cards can help you earn a variety of rewards and enjoy a range of benefits that align with your financial goals and lifestyle.

.

4. Leverage Rotating Category Rewards

Leveraging rotating category rewards is a savvy strategy to maximize the benefits of your credit cards, especially those with cashback or rewards programs. Some credit cards offer quarterly rotating categories that provide higher cashback or rewards rates for specific types of purchases, such as groceries, gas, or dining. To take full advantage of this feature, stay informed about the rotating categories and plan your spending accordingly.

- For example, if a particular quarter offers enhanced rewards for dining expenses, you can prioritize dining out or ordering in during that period. By strategically aligning your spending with these rotating categories, you can earn more rewards or cashback on everyday purchases and boost the overall value of your credit card. This approach requires awareness and planning, but it can significantly enhance your ability to save money or accumulate rewards over time.

.

5. Shop through Your Credit Card’s Online Portal

Shopping through your credit card’s online portal can be a convenient and financially rewarding strategy. Many credit card issuers offer online shopping platforms or portals that provide exclusive deals, discounts, and additional rewards for cardholders. By using these portals to make your online purchases, you can earn extra cashback, rewards points, or even access limited-time promotions that may not be available through other channels. It’s a hassle-free way to enhance the value of your credit card while shopping for products or services you would purchase anyway.

- However, it’s essential to check the terms and conditions of your credit card’s online portal, as the rewards and deals may vary. By taking advantage of this feature, you can make your regular shopping habits work to your financial advantage, ultimately saving money and accumulating more rewards with each purchase.

.

6. Redeem Points or Cashback for Gift Cards

Redeeming points or cashback for gift cards is a practical and flexible way to make the most of your credit card rewards. Many credit card rewards programs allow cardholders to exchange their earned points or cashback for gift cards from a wide range of retailers and brands. This option gives you the freedom to choose the gift cards that best suit your needs or preferences. Whether it’s for your favorite coffee shop, a popular clothing store, or an online retailer, these gift cards can be used for everyday purchases or special occasions.

- Additionally, redeeming for gift cards can provide a sense of financial flexibility, allowing you to treat yourself or loved ones without impacting your budget. It’s a convenient way to enjoy the tangible benefits of your credit card rewards, turning them into practical and enjoyable shopping experiences.

.

7. Utilize Price Protection and Purchase Insurance

Utilizing price protection and purchase insurance is a smart way to ensure peace of mind when making purchases with your credit card. Price protection can save you money by refunding the difference if you find the same item at a lower price shortly after your purchase. This feature is especially useful for big-ticket items like electronics or appliances. Purchase insurance provides added security by covering the cost of damaged, lost, or stolen items bought with your credit card, safeguarding your investment. To take full advantage of these benefits, make sure to read your credit card’s terms and conditions and understand the coverage limits and timeframes. By using these features, you not only enjoy added protection for your purchases but also increase the overall value of your credit card, making it a valuable tool for responsible and worry-free shopping.

.

8. Keep an Eye on Limited-Time Offers

Keeping an eye on limited-time offers is a shrewd strategy to maximize your credit card benefits. Many credit card issuers periodically roll out special promotions, discounts, or enhanced rewards for a limited duration. These offers can encompass a wide range of benefits, from bonus rewards points to statement credits, or even exclusive access to events. To make the most of these opportunities, it’s essential to stay vigilant and regularly check your credit card issuer’s website or app for updates. By taking advantage of these limited-time offers, you can significantly boost your credit card’s value, enjoy extra perks, and even save money on purchases or experiences that matter to you.

- Whether it’s a promotional cashback rate for dining out, a travel rewards bonus, or a generous sign-up bonus, being attentive to these special offers can help you make the most of your credit card’s advantages.

.

9. Use Reward Points for Travel

Using reward points for travel is a popular and rewarding way to make the most of your credit card’s benefits. Many credit cards offer travel rewards programs that allow you to redeem your earned points for flights, hotel stays, rental cars, and other travel-related expenses. This can translate into significant savings on your next vacation or business trip. To maximize this strategy, it’s essential to plan ahead and be flexible with your travel dates, as availability may vary based on demand. Additionally, some credit cards offer valuable travel perks, such as complimentary airport lounge access or travel insurance coverage, further enhancing your travel experience. By using reward points for travel, you can explore new destinations, enjoy unforgettable experiences, and make your credit card work for you while fulfilling your wanderlust.

.

10. Stay Within Your Budget

Staying within your budget is a fundamental principle for maintaining your financial health, and it’s essential to make the most of your credit card while avoiding unnecessary debt. While credit cards offer convenience and various benefits, they also carry the risk of overspending if not used responsibly. To make the most of your credit card, it’s crucial to set a clear budget and stick to it. Monitor your spending, track your transactions, and ensure that your credit card charges align with your financial goals and available funds. Avoid impulse purchases or using your credit card for non-essential expenses if it will lead to debt that you cannot comfortably repay. Responsible credit card use allows you to build a positive credit history, which can open doors to better financial opportunities in the future. By staying within your budget and using your credit card wisely, you can enjoy the convenience, security, and rewards while avoiding the pitfalls of debt and financial stress.

.

Conclusion

Holiday shopping doesn’t have to drain your bank account. By strategically using your credit cards and taking advantage of the rewards they offer, you can save money and even earn valuable perks while celebrating the season of giving. Be sure to research the rewards programs and benefits of your specific credit cards, and plan your holiday shopping accordingly. Maximize your credit card rewards, and make the most of this festive time of year. Happy shopping!

.

-

10 Strategies for Paying Off Student Loan Debt Faster

Paying off Student Loan Debt can be a burden for many individuals, affecting their financial well-being and future goals.

Paying off Student Loan Debt can be a burden for many individuals, affecting their financial well-being and future goals.Paying off student loan debt is a financial challenge that many graduates face as they embark on their post-education journey. The burden of student loans can linger for years, impacting your financial freedom and future goals.

These strategies encompass a variety of financial tactics, from making extra payments and exploring refinancing options to taking advantage of loan forgiveness programs and leveraging your income effectively.

Whether you’re a recent graduate or have been carrying student loan debt for some time, these insights will provide you with the knowledge and tools to accelerate your journey toward financial freedom and get ahead on the path to a debt-free future. So, let’s dive into the world of student loan debt repayment and discover the strategies that can help you achieve your goal of paying off your student loans quickly and efficiently. However, there are strategies you can employ to accelerate the process of paying off your student loans. In this blog post, we will explore effective strategies that can help you tackle your student loan debt faster, allowing you to achieve financial freedom and move forward with your life.

.

1. Create a Budget for Student Loans

Creating a budget specifically tailored to managing student loans is crucial for individuals who have borrowed funds to finance their education. A student loan budget allows borrowers to allocate their income strategically to cover their loan payments while also managing other financial obligations. Here are three examples of how a student loan budget can be structured:

- Fixed Payment Approach: In this budgeting approach, borrowers allocate a fixed amount each month towards their student loan payment. They calculate their minimum monthly payment and ensure that this amount is included in their budget as a top priority expense. By adhering to this fixed payment approach, borrowers can make consistent progress in repaying their student loans while managing other essential expenses and financial goals.

- Aggressive Repayment Strategy: Some borrowers may choose to adopt an aggressive repayment strategy by allocating a larger portion of their income towards their student loan payments. They aim to pay off their loans quickly, reducing the overall interest paid and becoming debt-free sooner. This approach may require sacrificing some discretionary expenses temporarily or finding ways to increase income to free up additional funds for loan repayment.

- Income-Driven Repayment Plan: For borrowers with federal student loans, an income-driven repayment plan may be an option. This type of plan adjusts the monthly payment based on the borrower’s income and family size. In this budgeting approach, borrowers allocate funds based on their income-driven repayment plan calculation, ensuring that the designated payment amount is covered while managing other expenses within their means. This approach provides flexibility for borrowers with variable incomes and allows them to maintain a manageable monthly payment.

By creating a student loan budget tailored to their financial situation and goals, borrowers can effectively manage their loan repayment while also maintaining financial stability and progress towards other financial objectives.

.

2. Make Extra Payments

Making extra payments towards student loans can be a smart strategy for borrowers looking to expedite their loan repayment and reduce the overall interest paid. By allocating additional funds towards student loan payments, borrowers can make significant progress in paying off their loans ahead of schedule. Here are three examples of how making extra payments can benefit borrowers:

- Lump Sum Payments: Borrowers can make one-time lump sum payments towards their student loans whenever they have surplus funds. This could be from a tax refund, work bonus, or any unexpected windfall. By applying these extra funds directly to the principal balance of the loan, borrowers can reduce the outstanding balance and potentially save on interest over the long term.

- Biweekly Payments: Instead of making the standard monthly payment, borrowers can divide their monthly payment amount in half and make biweekly payments. By doing so, they effectively make 13 full payments in a year instead of 12. This strategy allows borrowers to reduce the principal balance faster and pay less in interest over the life of the loan.

- Increased Monthly Payments: Borrowers can choose to increase their monthly payments by a fixed amount. For example, they can decide to add $100 or $200 extra to their regular monthly payment. By consistently paying more than the minimum required amount, borrowers can make steady progress in paying down their loans and potentially shorten the repayment term.

Making extra payments towards student loans requires careful budgeting and financial planning. Borrowers should ensure that any extra payments they make are applied directly to the principal balance and not towards future interest. By adopting this proactive approach, borrowers can take control of their student loan debt and achieve financial freedom sooner.

.

3. Explore Loan Forgiveness Programs

Exploring loan forgiveness programs can be a valuable avenue for borrowers looking to alleviate the burden of their student loans. These programs offer the opportunity to have a portion or even the entirety of the outstanding loan balance forgiven under certain qualifying conditions. Here are three examples of loan forgiveness programs that borrowers can explore:

- Federal Student Aid (U.S. Department of Education): The official website for federal student aid provides detailed information on various loan forgiveness programs, eligibility criteria, and application processes. For more information visit their website

- StudentAid.gov: This website, managed by the U.S. Department of Education, offers comprehensive information on federal student aid programs, including loan forgiveness options. You can access the loan forgiveness section directly

- The Federal Student Loan Forgiveness Program Database: This website provides a searchable database of loan forgiveness programs available across the United States. It allows you to filter programs by profession, state, and other criteria. Visit their website

- The Consumer Financial Protection Bureau (CFPB): The CFPB provides resources and guidance on student loan forgiveness programs, along with tools and information to help borrowers navigate the loan forgiveness process.

It’s important for borrowers to carefully review the specific eligibility requirements and conditions of each loan forgiveness program. Additionally, it’s recommended to keep detailed records of payments and meet all program requirements to ensure eligibility for forgiveness. Exploring loan forgiveness programs can provide significant relief for borrowers struggling with student loan debt and can pave the way towards a more secure financial future.

.

4. Refinance Your Loans

If you have good credit and a stable income, consider refinancing your student loans. Refinancing involves obtaining a new loan with a lower interest rate, which can potentially save you money over the life of the loan. However, carefully evaluate the terms and conditions before refinancing to ensure it aligns with your financial goals.

- Lower Interest Rates: One of the primary motivations for refinancing is to secure a lower interest rate. If you have improved your credit score or the market conditions have changed since you first took out your loans, refinancing can potentially qualify you for a lower interest rate. This can result in substantial savings over the life of your loan, allowing you to pay off your debt more efficiently.

- Simplified Repayment: Refinancing can simplify your repayment by combining multiple student loans into a single loan. Instead of managing multiple loans with varying interest rates and due dates, you’ll have one loan and one monthly payment to keep track of. This can streamline your finances and make it easier to manage your debt.

- Adjustable Repayment Terms: Refinancing offers the flexibility to adjust your repayment terms. For example, you can choose to extend your loan term to reduce your monthly payments, which can be helpful if you’re facing financial constraints. On the other hand, you can opt for a shorter loan term to pay off your debt faster and save on interest costs. By customizing your repayment terms, you can align your loan with your financial goals and preferences.

It’s important to note that refinancing federal student loans with a private lender may result in the loss of certain federal loan benefits such as income-driven repayment plans, loan forgiveness programs, and forbearance options. Before refinancing, borrowers should carefully evaluate the terms and benefits associated with their current loans and compare them with potential refinancing offers to determine if refinancing is the right choice for their unique financial situation

.

5. Prioritize High-Interest Loans

Prioritizing high-interest loans is a key strategy for borrowers looking to effectively manage their student loan debt. By focusing on loans with higher interest rates, borrowers can minimize the amount of interest accrued and pay off their debt more efficiently. Here are three examples of how prioritizing high-interest loans can benefit borrowers:

- Avalanche Method: With the avalanche method, borrowers prioritize loans based on their interest rates, paying off the loans with the highest rates first. By directing extra payments towards these high-interest loans while making minimum payments on other loans, borrowers can reduce the overall interest paid over time. This method allows borrowers to save money and pay off their debt faster.

- Snowball Method: The snowball method involves prioritizing loans based on their loan balances rather than interest rates. Borrowers start by paying off the loan with the smallest balance first while making minimum payments on other loans. As each loan is paid off, the borrower gains momentum and can use the freed-up funds to tackle larger loan balances. While this method may not save as much in interest compared to the avalanche method, it provides a psychological boost by eliminating smaller loans quickly and building motivation to continue paying off debt.

- Refinancing High-Interest Loans: Another approach is to explore refinancing options for high-interest loans. If borrowers can secure a lower interest rate through refinancing, they can reduce the overall cost of their loans. By refinancing high-interest loans with a private lender, borrowers can potentially save money on interest payments and accelerate their debt repayment.

Prioritizing high-interest loans is an effective strategy to save money and pay off student loan debt more efficiently. It’s important for borrowers to evaluate their loan terms, interest rates, and repayment options to determine the most advantageous approach for their specific situation. By focusing on high-interest loans, borrowers can make significant progress towards becoming debt-free.

.

6. Consider Bi-Weekly Payments

Considering bi-weekly payments is a smart strategy for borrowers looking to expedite their student loan repayment and save on interest. Instead of making a single monthly payment, bi-weekly payments involve splitting the monthly payment amount in half and making payments every two weeks. Here are three examples of how bi-weekly payments can benefit borrowers:

- Accelerated Repayment: Bi-weekly payments allow borrowers to make an extra full payment each year. Since there are 52 weeks in a year, making bi-weekly payments results in 26 half payments, which is equivalent to 13 full payments. This accelerated repayment schedule helps borrowers pay off their loans faster and reduce the overall interest paid over the life of the loan.

- Improved Budgeting: Bi-weekly payments align with many individuals’ income schedules, especially those who receive bi-weekly paychecks. By dividing the monthly payment into smaller, more frequent payments, borrowers can better manage their cash flow and budgeting. It can also help prevent missed or late payments by aligning payment dates with income receipt.

- Reduced Interest Accumulation: Making bi-weekly payments reduces the principal balance more quickly, which results in less time for interest to accrue. By consistently paying down the principal balance at a faster rate, borrowers can save on interest costs and potentially shorten the repayment term of their loans.

It’s important for borrowers to confirm with their loan servicer that bi-weekly payments are allowed and properly applied to the loan. Some servicers may require borrowers to set up automatic payments or may apply the additional payment towards the next regular monthly payment. By considering bi-weekly payments, borrowers can make consistent progress in paying off their student loans while minimizing the impact of interest on their overall loan balance.

.

7. Explore Income-Driven Repayment Plans

Exploring income-driven repayment (IDR) plans is a valuable option for borrowers struggling to meet their student loan payments based on their income. These plans adjust monthly payments based on borrowers’ discretionary income, making them more affordable and manageable. Here are three examples of IDR plans that borrowers can explore:

- Income-Based Repayment (IBR): IBR caps monthly payments at a percentage of the borrower’s income, typically around 10-15% of discretionary income. The repayment term is typically 20 or 25 years, depending on when the loans were first borrowed. After the repayment term, any remaining balance may be eligible for forgiveness, though it may be subject to income tax.

Pay As You Earn (PAYE): PAYE also sets monthly payments at a percentage of the borrower’s income, typically 10% of discretionary income. To qualify for PAYE, borrowers must demonstrate financial need. The repayment term is usually 20 years, and any remaining balance at the end may be eligible for forgiveness, subject to income tax.

- Revised Pay As You Earn (REPAYE): REPAYE is available to all borrowers with eligible federal student loans, regardless of financial need. It caps monthly payments at 10% of discretionary income and offers a repayment term of 20 or 25 years, depending on the types of loans. Under REPAYE, any remaining balance after the repayment term may be eligible for forgiveness, subject to income tax.

Exploring income-driven repayment plans can provide much-needed relief to borrowers facing financial challenges. These plans can help borrowers manage their student loan payments based on their income and family size, making them more affordable and sustainable. It’s important to note that while IDR plans can lower monthly payments, they may result in a longer repayment term and higher overall interest costs. Borrowers should carefully review the terms, conditions, and potential long-term implications of each IDR plan to determine the best fit for their financial circumstances.

.

8. Seek Employment Assistance Programs

Seeking employment assistance programs can be a valuable strategy for borrowers struggling to manage their student loans. These programs provide opportunities to reduce or eliminate student loan debt by working in specific fields or areas. Here are three examples of employment assistance programs that borrowers can explore:

- Public Service Loan Forgiveness (PSLF): PSLF is a program designed for borrowers working in eligible public service jobs, such as government organizations or nonprofit organizations. After making 120 qualifying payments while employed full-time in a qualifying public service position, borrowers may be eligible to have their remaining loan balance forgiven.

- State-Specific Loan Repayment Assistance Programs (LRAPs): Many states offer LRAPs to encourage professionals to work in specific sectors or underserved areas. These programs provide financial assistance to help repay student loans in exchange for working in designated fields such as healthcare, education, or legal services. The specific eligibility criteria and benefits vary by state.

- Employer Student Loan Repayment Assistance Programs: Some employers offer student loan repayment assistance as part of their employee benefits package. These programs provide financial assistance towards employees’ student loan payments, either through direct payments or matching contributions. Eligibility and program terms vary by employer, so it’s important to check with your employer or potential employers to determine if such benefits are available.

By leveraging employment assistance programs, borrowers can potentially reduce their student loan burden and accelerate their journey to debt-free status. It’s crucial to thoroughly research the requirements, eligibility criteria, and obligations associated with each program before pursuing them. Seeking employment assistance programs can provide a valuable avenue for borrowers to alleviate the financial strain of student loans and achieve long-term financial stability.

.

9. Live Frugally

Adopt a frugal lifestyle by cutting unnecessary expenses and redirecting those savings towards your student loan payments. Cook at home, reduce entertainment expenses, and find ways to save on everyday items. Small lifestyle adjustments can free up more money to put towards your debt.

- Budgeting and Expense Tracking: Creating a budget and tracking expenses can help borrowers identify areas where they can cut costs and make adjustments. This may involve reducing discretionary spending, such as eating out less frequently, limiting entertainment expenses, or finding affordable alternatives for daily expenses. By being mindful of their spending habits and making intentional choices, borrowers can free up additional funds to put towards their student loans.

- Minimizing Housing and Transportation Costs: Housing and transportation expenses often constitute a significant portion of an individual’s budget. By seeking affordable housing options, considering roommates, or exploring alternative transportation methods such as public transit, carpooling, or biking, borrowers can significantly reduce these expenses and allocate more money towards their student loan payments.

- Embracing a Minimalist Lifestyle: Embracing minimalism involves decluttering and focusing on living with fewer material possessions. By adopting this mindset, borrowers can avoid unnecessary purchases and prioritize experiences over material goods. This approach can lead to significant savings and allow borrowers to redirect funds towards paying off their student loans faster.

Living frugally requires discipline and a commitment to prioritize financial goals over short-term gratification. By embracing a frugal lifestyle, borrowers can not only manage their student loans effectively but also develop healthy financial habits that can benefit them in the long run.

.

10. Stay Motivated and Track Your Progress

Paying off student loan debt requires discipline and perseverance. Stay motivated by tracking your progress and celebrating milestones along the way. Consider using apps or spreadsheets to monitor your debt reduction progress and visualize how far you’ve come.

- Set Milestones and Celebrate Achievements: Break down your repayment journey into smaller milestones. For example, you can set a goal to pay off a specific portion of your loan or reach a certain number of payments made. Celebrate these milestones along the way to keep your motivation high. It could be as simple as treating yourself to a small reward or acknowledging your progress with friends and family.

- Visualize Your Progress: Create a visual representation of your progress, such as a debt repayment tracker or a chart that shows how much you’ve paid off over time. Seeing the numbers decrease and the progress you’ve made can serve as a constant reminder of your achievements and motivate you to continue working towards your goal.

- Connect with Supportive Communities: Join online forums, social media groups, or communities of individuals who are also paying off their student loans. Engaging with like-minded individuals can provide valuable support, advice, and motivation. Sharing your challenges and successes with others who understand what you’re going through can keep you motivated and help you stay on track.

Regularly reviewing your progress, celebrating milestones, and staying connected with a supportive community can provide the necessary motivation to keep pushing forward on your student loan repayment journey. Remember to focus on the progress you’ve made rather than the remaining balance, and always keep your end goal in mind. With dedication and perseverance, you can conquer your student loans and achieve financial freedom.

.

Conclusion

Paying off student loan debt faster requires dedication and a strategic approach. By creating a budget, making extra payments, exploring loan forgiveness programs, refinancing, prioritizing high-interest loans, considering bi-weekly payments, utilizing income-driven repayment plans, seeking employer assistance, living frugally, and staying motivated, you can accelerate

It’s important to remember that there is no one-size-fits-all approach, and finding the right combination of strategies that align with personal goals and financial situations is key. With determination, discipline, and a proactive mindset, borrowers can overcome their student loan debt and pave the way for a more secure and prosperous future.

.

Cheering To Your Success

Brenda | www.DesignYourFinances.com

Let’s Connect on Social Media! | Pinterest |

.

-

6 Most Used Different Types of Credit Scores

Different types of credit scores that lenders and credit reporting agencies use to evaluate an individual’s creditworthiness.

Different types of credit scores that lenders and credit reporting agencies use to evaluate an individual’s creditworthiness. Credit scores are numerical representations of an individual’s or a business’s creditworthiness, and they play a pivotal role in the world of finance. While most people are familiar with the concept of a credit score, what many may not realize is that there isn’t just one single type of credit score.

In fact, there are a variety of credit scoring models utilized by different entities, each with its own criteria and scale. This comprehensive guide aims to shed light on the different types of credit scores, providing a deeper understanding of how they work and the significant role they play in various financial transactions.

From FICO scores to VantageScores, we’ll explore the key variations in these models, helping you comprehend the intricacies of credit scoring and how it affects your financial journey. Understanding these different credit scores is not only a valuable financial skill but can also empower you to make more informed decisions regarding loans, credit cards, and other financial endeavors. So, let’s delve into the diverse world of credit scoring and unravel the nuances of these essential numbers. Credit scores play a significant role in determining your financial health and ability to secure loans or credit. However, many individuals may be unaware that there are multiple types of credit scores available, each with its own scoring model and methodology.

.

1. FICO Score

The FICO Score is the most widely recognized and used credit scoring model in the United States. It was developed by the Fair Isaac Corporation and ranges from 300 to 850. Lenders often rely on FICO Scores to assess creditworthiness and make lending decisions. The score is determined based on factors such as payment history, credit utilization, length of credit history, credit mix, and new credit applications.

Here are key components that are typically taken into account when calculating a FICO Score:

- Payment History (35%): This factor assesses your track record of making payments on time. Late payments, delinquencies, and accounts in collections can negatively impact your score.

- Amounts Owed (30%): This factor considers your credit utilization, which is the percentage of your available credit that you are currently using. High credit card balances relative to your credit limits can lower your score.

- Length of Credit History (15%): This factor takes into account the age of your credit accounts. A longer credit history tends to be more favorable, as it provides a more comprehensive view of your borrowing behavior.

- Credit Mix (10%): This factor evaluates the types of credit accounts you have, such as credit cards, loans, mortgages, etc. Having a diverse mix of credit can demonstrate your ability to manage different types of credit responsibly.

- New Credit (10%): This factor looks at recently opened credit accounts and credit inquiries. Opening multiple new accounts or having too many credit inquiries within a short period can negatively impact your score.

These factors are used to calculate your FICO Score, which ranges from 300 to 850. A higher score indicates a lower credit risk, making you more likely to qualify for favorable loan terms and interest rates. It’s important to note that different credit bureaus may have slightly different FICO Scores due to variations in the information they collect.

While the exact weightage of each factor may vary based on an individual’s credit history, understanding these general components can help you make informed decisions to improve or maintain a healthy FICO Score.

.

2. VantageScore

VantageScore is another popular credit scoring model that was jointly created by the three major credit bureaus: Equifax, Experian, and TransUnion. It uses a scoring range from 300 to 850, similar to the FICO Score. VantageScore takes into account similar factors as FICO, including payment history, credit utilization, credit age, credit mix, and recent credit behavior.

- Payment History (extremely influential): This factor assesses your payment behavior, including the presence of any late payments, delinquencies, or accounts in collections.

- Credit Utilization (highly influential): It considers the ratio of your credit balances to your credit limits across all your accounts. Keeping your credit utilization low is important for a positive impact on your score.

- Credit Age and Mix (moderately influential): This factor looks at the length of your credit history and the diversity of your credit accounts, including credit cards, loans, and mortgages.

- Credit Balances (less influential): It considers the total amount you owe across all your credit accounts.

- Recent Credit Behavior and Inquiries (less influential): This factor takes into account any recent credit applications or inquiries, as well as the opening of new credit accounts.

The specific percentage breakdown for each factor in the VantageScore model is not publicly disclosed. However, generally, payment history and credit utilization carry the most weight in determining the score, while credit age and mix, credit balances, and recent credit behavior have a lesser impact.

It’s important to note that VantageScore versions have evolved over time, with the most recent version being VantageScore 4.0. Each version may have slight differences in the factor weighting and scoring range. Lenders may also have their own preferences and scoring models.

Monitoring your VantageScore can help you gauge your creditworthiness and take steps to improve your credit health. Additionally, it’s essential to understand that different lenders may use different scoring models when evaluating credit applications

3. Experian PLUS Score

The Experian PLUS Score is a credit scoring model provided by Experian, one of the major credit bureaus. It is based on a range of 330 to 830 and uses a similar scoring methodology as the FICO Score. The PLUS Score assesses credit risk based on factors such as payment history, credit utilization, length of credit history, recent credit activity, and available credit.

The calculation of the Experian PLUS Score is based on the information contained in your credit report from Experian. While the specific formula is not publicly disclosed, the following factors are typically considered:

- Payment History: This factor assesses your track record of making on-time payments to your creditors. A consistent history of timely payments can positively impact your Experian PLUS Score.

- Credit Utilization: The percentage of your available credit that you are currently using, known as credit utilization, is taken into account. Keeping your credit utilization low, ideally below 30%, can help improve your score.

- Length of Credit History: The age of your credit accounts, both the oldest and newest, is considered. Generally, a longer credit history indicates more experience in managing credit, which can positively affect your score.

- Types of Credit: The diversity of your credit accounts, such as credit cards, loans, and mortgages, can influence your Experian PLUS Score. Having a mix of different types of credit can be beneficial.

- Recent Credit Activity: This factor looks at your recent credit behavior, including the opening of new accounts and credit inquiries. Opening multiple new accounts or having numerous credit inquiries within a short period may have a negative impact on your score.

While the Experian PLUS Score can provide a general sense of your credit standing, it’s crucial to review your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) and understand how your creditworthiness may be evaluated by lenders using more widely accepted scoring models.

.

4. TransUnion CreditVision Score

The TransUnion CreditVision Score is a credit scoring model developed by TransUnion, one of the major credit bureaus. It ranges from 300 to 850, like the FICO Score, and evaluates creditworthiness based on various factors such as payment history, credit utilization, credit age, credit mix, and recent credit behavior. It also incorporates alternative data sources to provide a more comprehensive assessment of creditworthiness.

It is designed to provide lenders with a more comprehensive and predictive assessment of an individual’s creditworthiness. The CreditVision Score incorporates a wider range of data and utilizes advanced analytics to generate a more accurate credit risk assessment.

- Payment History: This factor evaluates your payment behavior, including the timeliness of your credit obligations. Making on-time payments and avoiding late payments can positively impact your CreditVision Score.

- Credit Utilization: The amount of credit you are currently using compared to your total available credit is evaluated. Maintaining a low credit utilization ratio, ideally below 30%, can have a positive influence on your score.

- Length of Credit History: The age of your credit accounts, both individually and as an average across all accounts, is taken into consideration. A longer credit history can contribute to a higher score.

- Credit Mix: The types of credit you have, such as credit cards, loans, and mortgages, are evaluated. Having a mix of different types of credit accounts can contribute positively to your CreditVision Score.

- New Credit Applications: The number of recent credit applications and inquiries are factored in. Multiple inquiries within a short period may have a negative impact on your score.

- Recent Credit Activity: This factor looks at your recent credit inquiries and new credit accounts opened. Excessive inquiries or new accounts within a short period may have a temporary negative impact on your score.

It’s worth mentioning that the TransUnion CreditVision Score is just one of the credit scoring models used by lenders.

.

5. Equifax Credit Score

Equifax, another major credit bureau, provides its own credit scoring model known as the Equifax Credit Score. It uses a scoring range of 280 to 850 and considers factors such as payment history, credit utilization, credit age, credit mix, and recent credit behavior to assess creditworthiness.

The Equifax Credit Score is a credit scoring model provided by Equifax, one of the major credit bureaus. It is designed to assess an individual’s creditworthiness based on their credit history. The Equifax Credit Score ranges from 280 to 850, with a higher score indicating lower credit risk.

The exact calculation method and percentage breakdown used by Equifax for the Credit Score are not publicly disclosed. However, like other credit scoring models, several key factors are generally considered in determining the score:

- Payment History: This factor evaluates your payment behavior, including the timeliness of your credit obligations. Consistently making on-time payments can positively impact your Equifax Credit Score.

- Credit Utilization: The ratio of your outstanding credit balances to your total available credit, known as credit utilization, is taken into account. Keeping your credit utilization low, ideally below 30%, can have a positive effect on your score.

- Length of Credit History: The age of your credit accounts, including the average age of your accounts, is considered. A longer credit history is generally viewed favorably, as it provides more data points for assessing creditworthiness.

- Credit Mix: The types of credit you have, such as credit cards, loans, and mortgages, are evaluated. Having a mix of different types of credit accounts can contribute positively to your Equifax Credit Score.

- Recent Credit Activity: This factor looks at your recent credit inquiries and new credit accounts opened. Excessive inquiries or new accounts within a short period may have a temporary negative impact on your score.

It’s important to note that the specific calculation method and weightings of these factors may vary based on the version of the Equifax Credit Score used. Additionally, lenders and financial institutions may use different versions or modify the scoring model based on their specific requirements and risk assessments.

.

6. Industry Specific Credit Scores

In addition to the commonly known credit scoring models like FICO and VantageScore, there are industry-specific credit scoring models that cater to specific sectors. These credit industry-specific scores are designed to assess creditworthiness and manage risk within specific industries. Here are a few examples of credit industry-specific scoring models:

- FICO Auto Score: This scoring model is tailored for the automotive industry. It assesses an individual’s credit risk specifically for auto loans and helps lenders determine the likelihood of timely repayment and the appropriate terms for auto financing.

- FICO Bankcard Score: This scoring model focuses on credit risk assessment for credit card lending. It considers factors relevant to credit card usage and repayment behavior, providing credit card issuers with a more targeted evaluation of an individual’s creditworthiness for credit card applications.

- FICO Mortgage Score: This scoring model is designed for the mortgage industry. It evaluates an individual’s credit risk in relation to mortgage lending, taking into account specific factors that are relevant to the mortgage application process, such as payment history, debt levels, and length of credit history.

- FICO Small Business Scoring Service (SBSS) Score: This scoring model assesses the creditworthiness of small businesses. It considers both personal and business credit data to evaluate the risk of lending to a small business and is commonly used by lenders when making loan decisions for small business financing.

- PRBC Score: PRBC (Payment Reporting Builds Credit) is a credit scoring model that takes into account alternative credit data such as utility bills, rent payments, and other non-traditional forms of credit. It is designed to help individuals with limited credit histories or thin files establish creditworthiness.

- CE Score: The CE (Credit Education) Score is a credit scoring model developed by CreditXpert Inc. It focuses on educational factors and provides a score that reflects an individual’s credit knowledge and financial behavior.

- LexisNexis RiskView: LexisNexis RiskView uses alternative data sources, including public records, property records, and identity verification, to assess credit risk. It provides an additional layer of analysis for lenders to evaluate creditworthiness.

- Innovis Credit Score: Innovis is a lesser-known credit bureau that provides credit reports and scores. Their credit scoring model takes into account traditional credit factors but may also include alternative data sources.

These credit industry-specific scores help lenders in specific sectors make more informed lending decisions by considering factors that are most relevant to the particular industry. It’s important to note that these scoring models may have different scoring ranges and calculation methods compared to general credit scoring models. Lenders in each industry may prioritize certain factors and use different thresholds based on their specific risk management strategies.

.

Conclusion

Understanding the different types of credit scores is crucial for managing your creditworthiness and financial well-being. While FICO and VantageScore are the most commonly used credit scoring models, it’s essential to recognize that each scoring model may weigh factors differently, leading to variations in scores. Regardless of the specific scoring model, focusing on responsible credit management, timely payments, low credit utilization, and maintaining a healthy credit history will improve your creditworthiness across all scoring models. Regularly monitoring your credit reports and scores will help you stay informed and make informed financial decisions.

.

Cheering To Your Success

Brenda | www.DesignYourFinances.com

Let’s Connect on Social Media! | Pinterest |

.

-

16 Top and Effective Types of Credit

Types of credit refer to the various ways individuals can access funds or make purchases on credit, whether personal or business credit.

Types of credit refer to the various ways individuals can access funds or make purchases on credit, whether personal or business credit. Credit is the backbone of modern financial systems, allowing individuals and businesses to access funds and make purchases that might otherwise be out of reach. Yet, not all types of credit are created equal, and understanding the various options available is crucial for making informed financial decisions.

In this comprehensive guide, we’ll explore 16 top and effective types of credit, ranging from the most common, like credit cards and personal loans, to more specialized forms, such as mortgages and business lines of credit. Each type has unique features, benefits, and potential drawbacks, making them suitable for specific financial needs and situations.

Whether you’re seeking financing for personal endeavors, business ventures, or major purchases like a home or vehicle, this guide will equip you with the knowledge needed to navigate the diverse landscape of credit options effectively, helping you make the most of your financial opportunities and resources. So, let’s embark on this journey to discover the various types of credit and how they can empower you to achieve your financial goals.

.

1. Open Credit

Open credit, also known as open-ended credit, is a type of credit arrangement that provides borrowers with ongoing access to a predetermined credit limit.

Unlike installment credit or revolving credit, open credit does not have a fixed repayment schedule or a specified end date. Instead, borrowers can make purchases or borrow funds up to their credit limit and are required to make regular minimum payments based on their outstanding balance. Common examples of open credit include store credit cards and fuel cards. Open credit offers flexibility and convenience for individuals and businesses to make purchases and manage their cash flow needs. However, it’s important to use open credit responsibly and make timely payments to avoid excessive debt and maintain a positive credit history. Below is where to apply:

Online Lenders: Many online lenders offer open credit products, such as lines of credit, that can be conveniently applied for and managed online. Research reputable online lenders and visit their websites to explore available options

.

2. Bank Credit

Bank credit refers to the provision of funds by financial institutions, such as banks, to borrowers for various purposes.

It encompasses a wide range of credit products and services offered by banks, including loans, lines of credit, and credit cards. Banks assess the creditworthiness of borrowers based on factors such as income, credit history, and collateral to determine the terms and conditions of the credit provided. Bank credit plays a crucial role in stimulating economic growth by supporting businesses with capital for expansion, individuals with access to financing for major purchases, and facilitating the smooth functioning of the overall financial system. It is important for borrowers to understand the terms, interest rates, and repayment schedules associated with bank credit and to use it responsibly to maintain a positive credit profile.

- Banks: Most traditional banks offer various types of open credit products. You can visit their branches or check their websites to explore and apply for credit cards or lines of credit.

.

3. Revolving Credit

Revolving credit is a type of credit arrangement that provides borrowers with a predetermined credit limit that they can borrow against and repay repeatedly.

Unlike installment credit, which has fixed monthly payments, revolving credit offers flexibility in terms of repayment. Borrowers have the option to borrow and repay any amount within their credit limit, and interest is charged on the outstanding balance. Common examples of revolving credit include credit cards and lines of credit. Revolving credit allows individuals and businesses to have ongoing access to funds for everyday expenses, emergencies, or planned purchases. It offers convenience and flexibility but requires responsible management to avoid accumulating excessive debt. Making timely payments and keeping credit utilization low are key to maintaining a good credit score and maximizing the benefits of revolving credit.

- Credit Unions: Credit unions also provide credit cards with revolving credit options. Check the websites of credit unions in your area or membership eligibility to inquire about their credit card offerings.

.

4. Installment Credit

Installment credit refers to a type of credit arrangement where a borrower receives a lump sum of money or a purchase item and agrees to repay it in fixed monthly installments over a predetermined period.

This type of credit is commonly used for big-ticket purchases such as a car, home, or major appliances. Installment credit offers borrowers a structured repayment plan with fixed amounts, making it easier to budget and manage payments. The terms of the loan, including the interest rate and repayment period, are agreed upon at the time of borrowing. Installment credit can help individuals and businesses acquire necessary assets and investments while spreading out the cost over time. It’s important to carefully consider the terms and interest rates of installment credit and ensure that monthly payments can be comfortably met to avoid default and maintain a positive credit history. Example of a an installment:

- Auto Dealerships: If you are looking for an auto loan, visiting the websites or contacting local auto dealerships is another option. They often have partnerships with financial institutions that offer installment credit specifically for vehicle purchases

.

5. Trade Credit

Trade credit refers to a type of credit extended by suppliers to businesses, allowing them to purchase goods or services and pay for them at a later date.

It is a common form of credit utilized in business-to-business transactions, providing flexibility in managing cash flow and inventory needs. The terms and conditions of trade credit, such as the credit period and repayment terms, are typically negotiated between the buyer and the supplier. Trade credit can be advantageous for businesses as it helps build relationships with suppliers, enables inventory management, and allows for the efficient operation of the business. However, it is important to manage trade credit responsibly to avoid excessive debt and ensure timely payments to maintain strong supplier relationships. Type trade of trade credit:

- Suppliers and Vendors: The primary source of trade credit is the suppliers or vendors you work with. If you have established business relationships with specific suppliers, you can inquire with them about their trade credit policies and application processes.

.

6. Business Credit

Business credit refers to the creditworthiness and financial history of a business entity. It is separate from personal credit and is based on the business’s ability to manage its financial obligations.

Business credit is important for establishing credibility and accessing financing and trade credit from suppliers. Lenders and creditors use business credit scores and reports to evaluate the risk associated with extending credit to a business. Building a strong business credit profile involves establishing relationships with suppliers, paying bills on time, managing business finances responsibly, and keeping business and personal finances separate. Having good business credit can lead to better financing terms, higher credit limits, and increased opportunities for growth and expansion. Great business credit can actually save money in the long run. Some of the leading companies that offer business credit include:

- Financial Technology (Fintech) Companies: Fintech companies often provide digital platforms where you can apply for open credit products, such as credit lines or virtual credit cards. Research reputable fintech companies and visit their websites to explore available options

.

7. Mutual Credit

Mutual credit is a system of credit that is based on reciprocal exchanges between individuals or businesses within a community or network. In a mutual credit system, participants can offer goods, services, or resources to one another and receive credits in return.

These credits can then be used to obtain goods or services from other participants within the network. The key principle of mutual credit is that the value of the credits is determined by the goods or services exchanged rather than by a traditional currency. Mutual credit systems promote community cooperation, self-sufficiency, and resource sharing. They can be particularly beneficial for local economies, small businesses, and community organizations. By relying on mutual trust and collaboration, mutual credit systems provide an alternative means of exchange that bypasses the need for traditional forms of currency. There are many places of apply for mutual credit and the other one includes:

- Online Mutual Credit Platforms: There are online platforms that connect individuals or businesses looking to participate in mutual credit arrangements. These platforms often have their own membership processes and rules for participating. Examples include Community Exchange Systems (CES) and Mutual Credit Services. Research these platforms and explore their membership options.

.

8. Service Credit

Service credit refers to a form of credit that is given in recognition of an individual’s or organization’s service or contribution in a particular context. It is often used in fields such as government, military, and public service.

Service credit can be awarded for various reasons, including years of service, specialized training, or exceptional performance. It may come in the form of benefits, rewards, or additional privileges. For example, in the military, service credit may be given to personnel for their years of service, which can contribute to retirement benefits or career advancement. In government or public service sectors, service credit may be granted for additional leave or other benefits based on the length of service. Service credit serves as a way to acknowledge and appreciate the dedication and commitment of individuals or organizations, while also providing tangible benefits that recognize their contributions.

- Government Contract: this one of the most desired types of contract as they come with a multitude of rewards and economic advantages. First research what type of governments you qualify for, before applying as some come with limitations.

.

9. Consumer Credit

Consumer credit refers to the borrowing of money by individuals for personal use, such as purchasing goods, paying for services, or covering unexpected expenses.

It is a type of credit extended to consumers by financial institutions, such as banks, credit unions, or lending companies. Consumer credit can take various forms, including credit cards, personal loans, auto loans, and installment plans. These credit arrangements allow consumers to acquire goods and services immediately while spreading out the repayment over time. Consumer credit provides individuals with the ability to make larger purchases or meet financial needs that may be beyond their immediate means.

However, it is important for consumers to use credit responsibly, make timely payments, and avoid accumulating excessive debt, as failing to do so can negatively impact their credit score and financial well-being. It not wise to use credit when on a tight budget if there is no financial control. Understanding the terms, interest rates, and fees associated with consumer credit is essential for making informed decisions and managing personal finances effectively. One of the most common application are made with:

- Credit Card Issuers: Credit card issuers, such as American Express, Discover, and Capital One, provide consumer credit through their credit card offerings. Visit their websites or contact their customer service to explore their credit card options and apply for consumer credit

.

10. Peer to Peer Credit

Peer-to-peer (P2P) credit, also known as peer-to-peer lending or social lending, is a form of lending that connects individuals or businesses looking for loans directly with potential lenders.

P2P lending platforms serve as intermediaries, facilitating the borrowing and lending process without the involvement of traditional financial institutions. Through these platforms, borrowers can create loan listings, specify the amount needed, and provide relevant information, while lenders can review the listings and choose to fund them based on their risk appetite and desired returns. P2P credit offers benefits to both borrowers and lenders.

Borrowers can access funds quickly, often at competitive interest rates, while lenders can earn potentially higher returns compared to traditional savings or investment options. P2P credit has gained popularity as an alternative financing option, particularly for individuals or businesses with limited credit history or facing challenges in obtaining loans from traditional sources. However, it is important for both borrowers and lenders to carefully evaluate the risks involved, understand the terms and conditions, and conduct due diligence before engaging in P2P credit transactions. Some of most favored companies to apply for peer-to-peer credit are:

- LendingClub: is one of the largest peer-to-peer lending platforms in the United States. They facilitate personal loans for various purposes. Visit their website to learn more and apply for a loan.

- Prosper: is another popular peer-to-peer lending platform that offers personal loans to borrowers. You can visit their website to explore their loan options and complete an application.

- Upstart: its a platform that focuses on providing loans to borrowers with limited credit history or unconventional credit data. Visit their website to learn more and apply for a loan.

- Funding Circle: is a lending platform that specializes in providing business loans to small and medium-sized enterprises. If you’re a small business owner, you can explore their loan options and apply on their website.

.

11. Secured Credit

Secured credit refers to a type of credit that is backed by collateral, which serves as security for the loan or credit line.

Secured credit is commonly used for larger purchases, such as homes (mortgages) or vehicles, where the collateral’s value can provide reassurance to the lender. It can also be an option for individuals with limited credit history or lower credit scores who may have difficulty obtaining unsecured credit. In the event that the borrower defaults on their payments, the lender can seize the collateral to recover the outstanding debt.

In this case, the car acts as collateral, providing the lender with a level of security. Since the loan is backed by an asset, lenders may be more willing to offer lower interest rates and more favorable terms compared to unsecured loans. However, it’s important to note that defaulting on secured credit can result in the loss of the collateral.

- Auto Loans: When you finance the purchase of a car, the loan is often secured by the vehicle itself. If you fail to make the required payments, the lender can repossess the car to recover the remaining balance

.

12. Unsecured Credit

Unsecured credit refers to a type of credit that is not backed by collateral. Unlike secured credit, there is no specific asset or property that serves as security for the loan or credit line.

Instead, lenders rely on the borrower’s creditworthiness and repayment history to determine eligibility. With unsecured credit, the lender takes on more risk since there is no specific asset to recover in case of default. Therefore, lenders may impose stricter eligibility criteria and higher interest rates to mitigate this risk. It’s crucial for borrowers to make timely payments and manage their credit responsibly to maintain a positive credit history and access to unsecured credit options. Here’s an example of unsecured credit:

- Credit Cards: Credit cards are a common form of unsecured credit. When you use a credit card for purchases or cash advances, you are essentially borrowing money from the card issuer without providing any collateral. The credit limit assigned to your card is based on factors such as your credit score, income, and financial history. Since there is no collateral involved, credit card issuers typically charge higher interest rates compared to secured loans.

.

13. Lines of Credit

A line of credit is a type of credit that provides borrowers with access to a predetermined amount of money, which they can borrow from as needed.

It operates similarly to a credit card in that borrowers have a set credit limit, and they can borrow and repay funds within that limit.

Lines of credit provide flexibility and convenience to borrowers as they can draw funds only when necessary and pay interest only on the amount borrowed. This makes them useful for various purposes, such as home improvements, educational expenses, or business needs. However, it’s important to manage lines of credit responsibly and make timely repayments to avoid accumulating excessive debt and maintain a positive credit history.

- Home Equity Line of Credit (HELOC): A HELOC is a common example of a line of credit. It is a form of revolving credit that uses the borrower’s home equity as collateral. The borrower is given a credit limit based on a percentage of their home’s appraised value, minus any outstanding mortgage balance. They can then access funds from the line of credit as needed, and repay the borrowed amount with interest over time.

.

14. Retail Credit

Retail credit refers to a type of credit extended by retailers or merchants to customers for the purchase of goods or services. It is commonly used in retail environments where customers have the option to make purchases on credit directly from the store.

Retail credit allows customers to make purchases immediately and pay for them over time, usually with the option of minimum monthly payments. However, it’s important to manage retail credit responsibly to avoid accumulating high-interest debt and to ensure timely repayment. Retail credit can be a convenient option for those who frequently shop at a particular retailer and want to take advantage of special discounts or rewards associated with the store’s credit program. Here’s an example of retail credit:

- Store Credit Card: Many retailers offer their own branded credit cards, which customers can use exclusively at their stores. These credit cards often come with special perks, discounts, or rewards programs specific to that retailer. Customers can apply for these cards and, if approved, can use them to make purchases at the retailer’s stores or online. The credit card issuer typically handles the credit application and manages the credit terms and repayment process.

.

15. Loans

Loans refer to a financial arrangement in which a lender provides a specific amount of money to a borrower, who agrees to repay the loan amount along with any applicable interest and fees within a predetermined time frame.

Loans can be used for various purposes, such as purchasing a home, financing education, starting a business, or covering unexpected expenses. Other examples of loans include auto loans, mortgage loans, student loans, and business loans. Each type of loan has its own specific terms, requirements, and purposes. It’s important to carefully consider the terms and conditions of a loan, including the interest rate, repayment schedule, and any associated fees, before taking on the debt. Borrowers should ensure that they can comfortably afford the loan payments and understand the implications of borrowing the funds. Here’s an example of a common type of loan:

- Personal Loan: A personal loan is a type of unsecured loan that can be used for any purpose. Borrowers can apply for a personal loan from a bank, credit union, or online lender. The loan amount is determined based on factors such as the borrower’s creditworthiness, income, and financial history. Personal loans typically have fixed interest rates and repayment terms ranging from a few months to several years. The borrower receives the loan amount in a lump sum and repays it in equal monthly installments.

.

16. Credit Cards

A credit card is a plastic payment card that allows the cardholder to make purchases and borrow money up to a certain credit limit. It is a revolving line of credit provided by a financial institution, typically a bank.

When a purchase is made using a credit card, the cardholder is essentially borrowing money from the credit card issuer. The cardholder has the option to pay the full balance by the due date or make a minimum payment and carry the remaining balance to the next billing cycle, incurring interest charges on the unpaid balance.

Credit cards offer convenience and flexibility, allowing cardholders to make purchases online, in-store, or over the phone. They also often come with additional benefits like rewards programs, cashback offers, travel insurance, and purchase protection. However, it’s important to use credit cards responsibly and pay off the balance in full each month to avoid accumulating high-interest debt. Here’s an example of how a credit card works:

- Visa Credit Card: Visa is a well-known credit card issuer that offers a variety of credit cards to consumers. When a person applies for a Visa credit card and is approved, they receive a physical card with a unique card number, expiration date, and security code. The cardholder can then use the Visa credit card to make purchases at any merchant that accepts Visa.

.

Conclusion

Understanding the different types of credit available to you is crucial for making informed financial decisions. Whether you need flexibility with revolving credit, predictable payments with installment loans, or specialized financing like mortgages or student loans, selecting the right type of credit based on your needs and goals is essential. Remember to consider factors such as interest rates, repayment terms, collateral requirements, and fees when evaluating credit options.

.

Cheering To Your Success

Brenda | www.DesignYourFinances.com

Let’s Connect on Social Media! | Pinterest |

.

-

10 Steps to How to Report Identity Theft

How to Report Identity Theft involves notifying the appropriate authorities and taking necessary steps to protect yourself and mitigate the damage caused by the theft.

How to Report Identity Theft involves notifying the appropriate authorities and taking necessary steps to protect yourself and mitigate the damage caused by the theft.Identity theft is a pervasive and distressing crime that can have severe consequences for victims, both financially and emotionally. When faced with the alarming reality of identity theft, taking immediate action is crucial to mitigate the damage and reclaim your identity.

In this blog post, we will outline ten essential steps on how to report identity theft effectively. From documenting the incident and contacting the necessary authorities to notifying financial institutions and credit reporting agencies, these steps will guide you through the process of reporting identity theft and working towards resolution.

We’ll also provide insights on how to protect your personal information, prevent future incidents, and rebuild your credit and financial standing. By understanding the steps to take when facing identity theft, you can take control of the situation and begin the journey toward reclaiming your identity and securing your financial future. So, let’s embark on this crucial journey to discover how to report identity theft and regain the peace of mind that comes with knowing your personal information is safeguarded.

.

1. Act Quickly

As soon as you suspect identity theft, take immediate action to report and address the issue.

- Acting quickly is essential when it comes to reporting identity theft. As soon as you suspect that your personal information has been compromised, it’s crucial to take immediate action.

- By acting swiftly, you can minimize the potential damage and limit the financial and emotional impact of identity theft. For example, if you notice unauthorized transactions on your bank statement, contact your bank right away to report the fraudulent activity and request assistance in securing your account.

The sooner you report the identity theft, the better chance you have of recovering your stolen information and preventing further harm. Time is of the essence when it comes to protecting your identity, so don’t hesitate to take prompt action.

.

2. Contact The Authorities

File a report with your local police department or the law enforcement agency where the identity theft occurred. Provide them with all relevant information and any evidence you have.

- When you become a victim of identity theft, it’s important to contact the authorities to report the incident. Reach out to your local law enforcement agency and file a police report detailing the theft. This step is crucial as it creates an official record of the crime and can aid in the investigation. Additionally, reporting the incident to the authorities helps protect others from falling victim to the same identity thief.

- Remember to provide all relevant details, such as the fraudulent accounts, suspicious activities, and any supporting evidence you have gathered.

Reporting the identity theft to the authorities is an essential step in the process of resolving the situation and holding the responsible party accountable.

.

3. Notify the Federal Trade Commission (FTC)

Visit the FTC’s website or call their Identity Theft Hotline at 1-877-438-4338 to report the identity theft. The FTC will provide you with a personalized recovery plan and assist you in navigating the process.

- When you have fallen victim to identity theft, it is crucial to notify the Federal Trade Commission (FTC) about the incident.

- The FTC is responsible for handling and tracking cases of identity theft nationwide. By reporting to the FTC, you contribute to their efforts in combating identity theft and provide valuable information for statistical analysis and law enforcement purposes.

- You can file a complaint online through the FTC’s official website or by calling their toll-free hotline. The FTC will provide you with a personalized recovery plan and guide you through the necessary steps to mitigate the impact of identity theft.