10 Holiday Money Saving Challenges

Holiday Money Saving Challenges are a fantastic way to inject an element of fun and motivation into the often hectic and expensive holiday season.

Holiday Money Saving Challenges are a fantastic way to inject an element of fun and motivation into the often hectic and expensive holiday season.

These challenges are designed to encourage individuals and families to save money in creative and engaging ways. Whether it’s the classic “365-Day Money Challenge,” where you incrementally save a specific amount each day, or a themed challenge that involves reducing unnecessary expenses, these challenges promote financial discipline and goal-setting during a time when spending can easily spiral out of control.

They provide a structured framework for saving, helping participants set realistic targets and watch their savings grow over the weeks or months leading up to the holidays.

Additionally, holiday money-saving challenges foster a sense of accomplishment and pride as participants see their efforts translate into extra funds for holiday shopping, travel, or simply building a more secure financial future. These challenges also encourage people to think outside the box, discover clever ways to cut costs, and foster a spirit of financial responsibility while still embracing the festive atmosphere of the holiday season. Ultimately, holiday money-saving challenges transform saving money from a chore into an exciting journey, and they demonstrate that with a bit of determination and creativity, you can celebrate the holidays without breaking the bank.

.

Budget Planner

Budget Planner

This is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar that tracks spending & savings

- 4 pages for debt tracking, 2 pages for Holiday budgeting,

- 2 pages for regular bill tracking, and 2 pages for annual

.

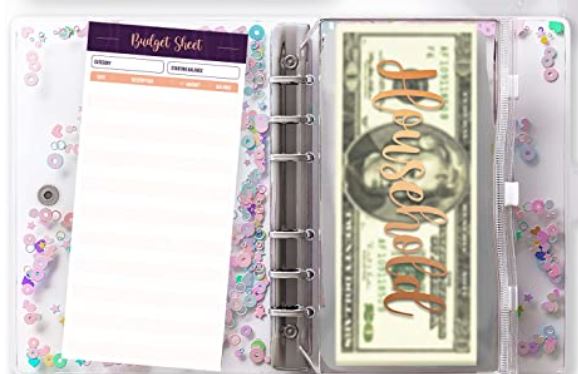

Cash Method Binder

Cash Method Binder

This cash binder is great for cash budgeting method

- Can easily use the cash method

- Can easily organize track your cash

- Comes with 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

.

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

.

.

1. The 25-Day Advent Challenge

- This classic challenge involves saving a specific amount each day for 25 days leading up to Christmas. Start with $1 on Day 1, $2 on Day 2, and so on, until you reach $25 on Day 25. By the end of the challenge, you’ll have $325 saved for holiday expenses

Participants eagerly open a daily ‘savings door,’ revealing a new and engaging way to save money. These challenges can vary from simple actions like packing lunch instead of eating out to more substantial steps like setting aside a specific amount each day. By the time Christmas arrives, participants not only have a significant amount of money saved but also a sense of accomplishment and the satisfaction of having celebrated the holidays in a financially savvy way. The 25-Day Advent Challenge is a heartwarming and exciting approach to embracing the holiday spirit while nurturing responsible financial habits.

.

2. The Reverse Savings Challenge

- Flip the savings challenge around by starting with a larger amount and decreasing it each day. Begin with $25 on Day 1 and subtract $1 each day until you reach $1 on Day 25. You’ll still have $325 by Christmas.

Instead of starting with small amounts and gradually increasing them, as seen in traditional savings challenges, the Reverse Savings Challenge begins with a significant amount and reduces the savings goal as time progresses. Participants commit to saving a substantial sum at the beginning, often aligning with their specific financial goals, such as a holiday shopping budget, a vacation fund, or an emergency fund.

As time passes, the amount to be saved decreases, allowing participants to ease into their savings routine without the pressure of increasing contributions. This approach recognizes that it can be challenging to consistently save larger sums, especially during the holiday season, and thus encourages people to prioritize their financial goals early on. The Reverse Savings Challenge offers a realistic and effective strategy for building financial resilience and achieving specific savings objectives, making it a practical and strategic approach to holiday money saving.

.

3. The Weekly Savings Challenge

- Save a set amount each week, such as $10 in Week 1, $20 in Week 2, and so on, until you save $50 in Week 5. Over five weeks, you’ll accumulate $150 for the holidays.

The Weekly Savings Challenge is a fantastic and versatile approach to saving money that suits a variety of financial goals and lifestyles. In this challenge, participants commit to saving a specific amount of money each week throughout the year, which can be adjusted to align with their unique financial situation and objectives. It’s an ideal method for cultivating a consistent savings habit, as it’s not overly burdensome and can be customized to suit individual budgets.

It serves as an excellent financial discipline tool, encouraging people to prioritize savings in their budget and create a sense of financial security. The challenge promotes the gradual growth of savings over the course of a year, cultivates a habit of consistent saving that extends well beyond the festivities, making it a highly effective and adaptable approach to holiday money-saving

.

4. The Spare Change Challenge

- Collect your spare change throughout the holiday season and deposit it into a designated savings jar. Those coins can quickly add up to a substantial amount by the end of the season.

The Spare Change Challenge is a clever and painless way to save money that leverages the loose coins and small bills that often accumulate in our daily lives. It encourages participants to collect and set aside their spare change, putting it to work for their financial goals. The simplicity of this challenge is its key strength; it requires no complex calculations or large contributions.

Over time, this seemingly insignificant change can amass into a significant sum, making it an ideal method for funding holiday expenses or any other financial goal.

.

5. The DIY Gift Challenge

- Challenge yourself to create homemade gifts for your loved ones. This not only saves money but also adds a personal touch to your holiday presents.

The DIY Gift Challenge is a heartwarming and budget-friendly approach to the holiday season that emphasizes creativity, personalization, and thoughtfulness in gift-giving. In this challenge, participants commit to creating their own gifts instead of purchasing store-bought items. Whether it’s handcrafted ornaments, homemade baked goods, or personalized photo albums, the DIY Gift Challenge encourages individuals to invest their time, skills, and love into crafting unique presents for their loved ones. This approach not only saves money but also offers the opportunity to express genuine care and consideration for the recipients.

It’s an embodiment of the true spirit of gift-giving, where the thought and effort behind the present often mean more than its price tag.

.

6. The No-Spend Weekend Challenge

- Designate certain weekends as “no-spend” weekends, during which you avoid making any unnecessary purchases. The money saved can be set aside for holiday spending.

The No-Spend Weekend Challenge is a practical and eye-opening approach to saving money that encourages participants to temporarily cut back on their discretionary spending during weekends. In this challenge, individuals commit to refraining from making any non-essential purchases over the course of a weekend. This can include dining out, shopping for non-essential items, or indulging in entertainment that comes with a price tag.

It helps participants distinguish between needs and wants, fostering a more conscientious approach to their finances. Moreover, it offers the opportunity to explore alternative, cost-effective activities, such as picnics, hiking, or at-home movie nights, which can be equally enjoyable without the expense. By consistently implementing this challenge, participants can build up significant savings that can be directed toward holiday expenses or other financial goals. It is a powerful and pragmatic approach to curbing unnecessary spending, leading to a more financially secure and mindful approach to budgeting.

.

7. The Second-Hand Shopping Challenge

- Commit to buying holiday decorations, gifts, or clothing from thrift stores or online marketplaces like eBay or Facebook Marketplace. You’ll find unique and affordable items.

The Second-Hand Shopping Challenge is a sustainable and budget-friendly approach to holiday shopping that involves seeking out pre-owned or thrifted items instead of purchasing new ones. In this challenge, participants commit to exploring second-hand stores, garage sales, online marketplaces, and other sources for gently used items that can serve as gifts or holiday decorations.

It also emphasizes the value of thoughtful and sustainable gift-giving, as second-hand items often come with interesting histories or stories. Additionally, this challenge provides an opportunity to support local thrift stores and contribute to a circular economy.

.

8. The Energy-Saving Challenge

- Cut down on energy consumption by using LED lights, lowering your thermostat, and unplugging devices when not in use. The money saved on utility bills can fund your holiday expenses.

The Energy-Saving Challenge is an eco-conscious and financially savvy approach to the holiday season that focuses on reducing energy consumption in and around the home. During the holidays, many of us indulge in festive lighting and decorations, which can significantly contribute to higher energy bills.

In this challenge, participants commit to making small yet impactful changes to their energy habits, such as using LED lights for decorations, setting thermostats at energy-efficient temperatures, or unplugging devices not in use. The goal is to enjoy the holiday season while being mindful of energy usage, which not only benefits the environment but also leads to lower energy bills.

.

9. The Potluck Challenge

- Host potluck dinners or gatherings with friends and family, where everyone contributes a dish. This reduces the cost of entertaining while enjoying a variety of foods. In this inflation – this seems like a great idea and not burden one wallet.

The hosting party invites their guests to contribute dishes or food items, turning the gathering into a potluck-style feast. This approach not only reduces the financial burden on the host but also encourages a sense of togetherness and shared celebration. It allows everyone to showcase their culinary talents and cultural traditions, resulting in a rich and diverse spread of dishes and embodies the true spirit of holiday celebrations, emphasizing the joy of sharing and community.

.

10. The Give-Back Challenge

- Instead of spending on traditional gifts, donate to a charity or cause that resonates with you. You can choose to make a one-time donation or set up a recurring contribution throughout the season.

The Give-Back Challenge is a heartwarming and impactful approach to the holiday season that centers around acts of kindness, generosity, and community involvement. In this challenge, participants commit to dedicating a portion of their time and resources to giving back to their community or supporting charitable causes.

This can include volunteering at local organizations, donating to food drives, sponsoring families in need, or simply spreading kindness in their daily interactions. It encourages individuals to reflect on the true meaning of the holidays, which is not solely about material gifts but also about love, compassion, and helping those in need. This challenge fosters a sense of empathy, unity, and social responsibility, as participants come together to make a difference in the lives of those less fortunate.

.

Conclusion

With these 10 Holiday Money Saving Challenges, you can enjoy the festive season without financial stress. Whether you opt for the Advent Challenge, the DIY Gift Challenge, or the Give-Back Challenge, there are plenty of creative ways to save money while creating joyful holiday memories. Explore the provided examples and links to help you plan an affordable and successful holiday season, filled with financial prudence and seasonal delight. Happy Holidays and the true meaning is being around the ones you love and spreading love.

.